Budget Business

Budget Business Download Help License +bizpep.com

Budget Business provides an effective means to generate a budget for up to five years. Full flexibility allows you to add Revenue, Variable Cost and Fixed Cost categories and lines to suit any business. Operation is via an easy to use toolbar and function buttons. The budget can be displayed in any combination of month, quarter, or year. Change indicators provide means to adjust revenue and costs year on year with initial default values applied to minimize input requirements and simplify use. Full what if and sensitivity analysis is available by varying the Change indicators. Budgets can be freely formatted for printing and graphing. Budget Business is suitable for both existing and proposed businesses.

Budget Business Download Help License +bizpep.com

Download Budget Business

Download Budget Business - Compressed Zip file

budgetbusiness.zip

or

Download Budget Business - .xlsm file

budgetbusiness.xlsm

This application is a macro-enabled spreadsheet developed in Microsoft Excel and will only function when opened using a spreadsheet program with macros enabled. You can download Budget Business free of charge for evaluation. In evaluation mode some functionality is restricted. To license your application and fully enable all functions requires the purchase of an application license. If you have not already please consider buying a license to fully enable your application.

If you download the Compressed Zip file unzip/uncompress the downloaded file and save the content .xlsm application file. If you download the .xlsm file simply save the .xlsm file. Open the .xlsm file and follow the instructions. Macros must be enabled for this application to function. If you cannot access input or command buttons do not operate macros are not functioning. In this case please refer to your spreadsheet help to enable macros. This application does not access or alter your system or system files in any way. To uninstall simply delete the saved files.

Application suitability must be independently assessed and use indicates acceptance of any and all associated risk.

Budget Business Download Help License +bizpep.com

Help Budget Business

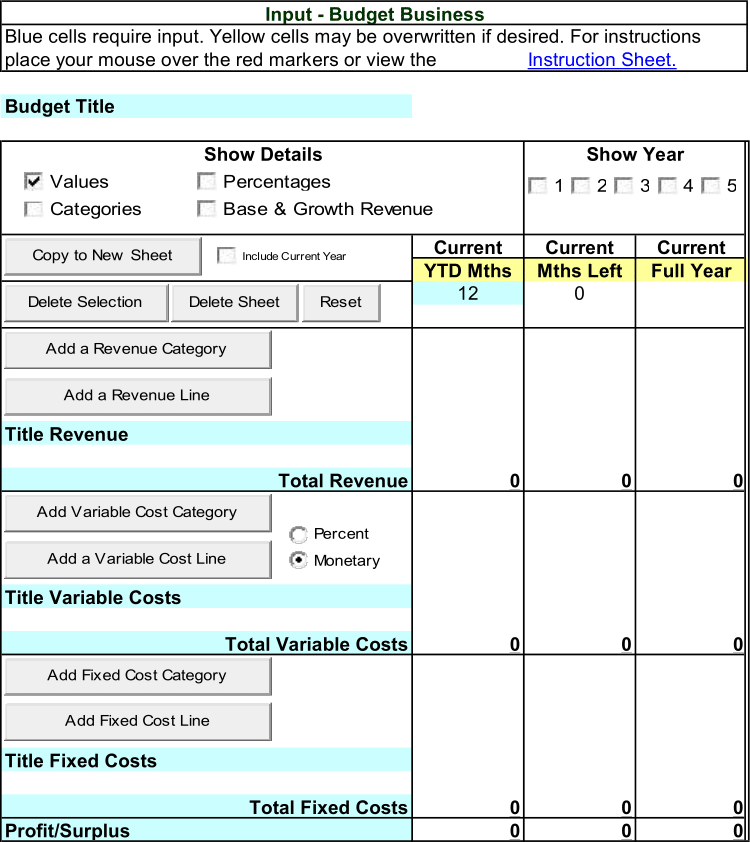

All input is on the Input sheet. Blue cells require input. Yellow cells may be overwritten if desired. Place your mouse over the red markers on the Input sheet for details. Following is a Step by Step outline and function details. Functions are activated by buttons and check/option boxes. Toggle between sheets using the tabs at the bottom of the window. In evaluation mode changes are reset on close and cannot be saved.

Step 1 - Set Up

Input an identifier for your budget in the Budget Title cell. To build your budget you require base revenue and cost data. If you are budgeting for an existing business this can be current profit and loss details. If you are budgeting for a new venture you require estimates for fixed costs and variable costs. If your base data only covers a portion of a year input the number of months the data applies for in in blue cell below YTD Months. Data for the remaining months will be calculated. If you are using data for a full year input 12 in the blue cell below YTD Months. To remove added lines select the line to delete and use Delete Selection. To start a new budget use Reset.

Step 2 - Revenue

To add base revenue select a row within the revenue area and click Add a Revenue Line or Add a Revenue Category. Name the revenue and input the base value. You can add as many revenue categories or lines as you require.

Step 3 - Variable Costs

Variable costs can be input as monetary values or percentages of revenue. Select you desired input in the Input Set for box. If you select Input Set for Percent you must also select Percentages in the Show Details box. To add base variable costs select a row within the costs area and click Add a Variable Cost Line or Add a Variable Cost Category. Name the variable cost and input the base value. You can add as many variable cost categories or lines as you require.

Step 4 - Fixed Costs

To add base fixed costs select a row within the costs area and click Add a Fixed Cost Line or Add a Fixed Cost Category. Name the fixed cost and input the base value. You can add as many fixed cost categories or lines as you require.

Step 5 - Forecast Data

To build your budget for following years select year 1 in the Show Year box. Then for Year 1 select Change and Months. Input the first month for your budget. In the Change column blue cells input your default increase / decrease (Inc/Dec) for revenue, variable costs, and fixed costs to indicate the percentage change year on year. For variable costs this percentage change applies to the variable cost percentage of revenue. For revenue and fixed costs it applies to the value. For the first 11 months in Year 1 input a percentage by month value (% by Mth) in the blue cells to indicate the percentage of annual revenue each month contributes.

Step 6 - Refine

The values in your Inc/Dec and % by Mth cells are applied as defaults to generate a full five year budget. For each individual revenue or cost line you can over write the default value. All yellow cells can be adjusted as required. Once you have completed your budget Copy to New sheet to save. This will display your budget with all the level of detail you currently have on show and will include current year data if selected. This sheet includes values and formula allowing further adjustments if required. You can then plot the revenue and profit levels for the displayed view and print as required.

Budget Identifier

Input an identifier for your budget.

Yellow Labels

You can change the default labels in yellow cells if desired.

Number of Months

Input the number of months that you have data for. If you have revenue and expense data for 6 months input 6 in this cell. Then input your data in this column. If you input less than 12 data for the remaining year will be calculated. To use your own full year data set this cell to 12 and input your full year data in this column. To build a budget for a new business set this cell to 12 and input projected revenue for your first month multiplied by 12 to set a base point. Year 1 revenue will grow monthly from this point according to the annual % Change Increase/Decrease you apply. Input Variable Costs as a Monetary amount (12 x first month costs for a new business) or as a Percent of revenue and input Fixed Costs for a full year.

Show Details

Click the boxes to Show or Hide detail.

Show Year

Click the boxes to Show or Hide detail.

Copy to New Sheet

Copy to New Sheet will save your completed budget to an new sheet in the form of the current layout. This may take a couple of minutes, increasing with the size of your budget.

- Set the budget to the required display, i.e. Show Years, Percentages etc.

- Select Include Current Year if you wish to include current year data.

- Click Copy to New Sheet.

You will be asked to input a Sheet Name and your budget will be saved to this sheet. From this sheet you can format and print as required. Blue cells indicate values that have been pasted and can be changed, other cells include formulas and should not be changed. To Update the Budget Chart with your New Sheet data select the New Sheet tab and then select the Budget Chart tab. The Budget Chart Plots the Total Revenue and Profit for all data columns included in the previously selected new sheet except the last column. The last column is usually full year data. If you wish to plot full year data include a Variation column after the last full year data. You can include you own charts by inserting them in the New Sheet. Please note that the first column and the second column from the end of your budget will include identifiers used in formula. These columns should not be modified. All required lines should be added on the Input Base Data Sheet before you copy to the New Sheet. If you delete or add columns or rows in the new sheet formulas may be corrupted. Formulas will also produce error results when the source data columns are not included i.e. the variation formulas will not work if the previous year is not included in the new sheet.

Delete Selection

Select a cell in the Line or Category you wish to delete. Click Delete Selection. This will delete all rows associated with the selected line or category. You can only delete rows that have been added.

Delete Sheet

Delete Sheet allows you to delete sheets that have been added using the Copy to New Sheet function. It only removes added sheets.

Reset

Reset removes all added detail and data, returning the Input Base Data sheet to its initial state. Before a new budget is commenced Reset to clear previous data.

Add a Revenue Category and Add a Revenue Line

Revenue can be added within categories or as individual lines. To define a revenue category select a cell within the revenue area and click Add a Revenue Category. You can then name your category and add additional revenue lines within it. If categories are not required select a cell within the revenue area and click Add a Revenue Line. For each revenue line input a title and a value for the Current Year, Year to Date. The number of months for the Year to Date must be input in the blue cell at the top of the column.

Revenue

Revenue for the each of the budget years consists of 2 components. Base Revenue, which is the same as the previous year (no change year on year), and Growth Revenue, which is the difference between the previous year and the budget year. Base Revenue is allocated to each month according to its Percentage by Month (% by Mth). The default value assumes all months contribute equal revenue giving 8.3333% (1/12) for all months. This is unlikely as the revenue of most businesses tends to vary due to seasonal influences such as weather, holiday periods, etc. You should adjust these values to reflect monthly revenue variations in your business. The amount of Growth Revenue is determined by the revenue Increase/Decrease (Inc/Dec) percentage applied. Growth Revenue is distributed across the months by considering the Percentage by Month and the Compounding Growth Affect. If you secure one new customer a month to generate your Growth Revenue then in month 1 you have Growth Revenue from one new customer, in month 2 you have Growth Revenue from 2 new customers (the customer secured in month 1 and the customer secured in month 2). This Compounding Growth Affect is adjusted by the Percentage by Month to calculate the amount of Growth Revenue allocated to each month. Imagine the Percentage by Month for month 2 is half that of month 1 due to seasonal factors halving the number of customers in month 2. The average number of new customers you could secure in month 2 will also be halved by this downturn in demand resulting in a decrease in the amount of Growth Revenue that can be secured.

Add a Variable Cost Category, Add a Variable cost Line, and Input Set for

Variable costs vary with revenue. Only include these costs in this area. Input for variable costs can be as a percentage of revenue (Percent) or a monetary amount (Monetary). To apply your required input select either Percent or Monetary. If you select Percent you must also select Percentages in Show Details so you can input your percentage data. Variable costs can be added within categories or as individual lines. To define a variable cost category select a cell within the variable cost area and click Add a Variable Cost Category. You can then name your category and add additional variable cost lines within it. If categories are not required select a cell within the variable cost area and click Add a Variable Cost Line. For each variable cost line input a title and a value for the Current Year, Year to Date.

Variable Costs

Variable cost amounts are calculated as a percentage of revenue for the corresponding period. During a year variable cost values vary with revenue but their percentage remains constant. Increase / Decrease (Inc/Dec) percentages apply to the variable cost percentage not the variable cost amount. For example if current revenue is $100, and variable costs are $40 or 40%. For the following year I set the revenue Inc/Dec to 100% (doubling revenue to $200) and I set the variable cost Inc/Dec to 50%. This increases the variable cost percentage to 60% giving a variable cost value of $120 (60% of $200).

Add Fixed Cost Category and Add Fixed Cost line

Fixed costs remain constant (up to a point) regards of revenue variations. Only include these costs in this area. Fixed costs can be added within categories or as individual lines. To define a fixed cost category select a cell within the fixed cost area and click Add a Fixed Cost Category. You can then name your category and add additional fixed cost lines within it. If categories are not required select a cell within the variable cost area and click Add a Fixed Cost Line. For each fixed cost line input a title and a value for the Current Year, Year to Date. The number of months for the Year to Date must be input in the blue cell at the top of the column.

Fixed Costs

Fixed cost values are constant during the year they do not vary with revenue. Monthly fixed cost values are calculated as 1/12 of annual fixed costs. Increase / Decrease (Inc/Dec) percentages apply to the fixed cost value. For example if current fixed costs are $50 and for the following year I set the fixed cost Inc/Dec to 10% fixed costs will increase to $55 regardless of revenue.

Profit/Surplus

Profit/Surplus is Revenue less Variable Costs less Fixed Costs.

Inc/Dec Revenue

Input a Revenue Increase / Decrease (Inc/Dec) percentage for the year. This is the percentage change in revenue year on year. For example if Current Year revenue is $100 and revenue Inc/Dec is set to 20%. Revenue for Year 1 will be $120. This will consist of $100 Base Revenue distributed according to the Percentage by Month (% by Mth) and $20 Growth Revenue distributed according to the Percentage by Month and the Compounding Growth Affect. Year 1 revenue Increase / Decrease percentages are applied as default values to all added Year 1 revenue lines and as the default for following years. You can overwrite these if desired.

Inc/Dec Variable Costs

Input a Variable Cost Increase / Decrease (Inc/Dec) percentage for the year. This applies to the variable cost percentage not the variable cost value. For example if current revenue is $100, and variable costs are $40 or 40%. For the following year I set the revenue Inc/Dec to 100% (doubling revenue to $200) and I set the variable cost Inc/Dec to 50%. This increases the variable cost percentage to 60% giving a variable cost value of $120 (60% of $200). Year 1 variable cost Increase / Decrease percentages are applied as default values to all added Year 1 variable cost lines and as the default for following years. You can overwrite these if desired.

Inc/Dec Fixed Costs

Input a Fixed Cost Increase / Decrease (Inc/Dec) percentage for the year. This applies to the fixed cost value. For example if current fixed costs are $50 and for the following year I set the fixed cost Inc/Dec to 10% fixed costs will increase to $55 regardless of revenue. Year 1 fixed cost Increase / Decrease percentages are applied as default values to all added Year 1 fixed cost lines and as the default for following years. You can overwrite these if desired.

Budget Start Month

Input the first month for your budget in month year format (e.g. Apr 22).

Budget following Months

Month Cells are calculated as the previous month plus 31 days. Year 1 month labels are applied to all following years. You can overwrite these cells if desired.

% by Month

For the first 11 months of the year input the Percentage by Month (% by Mth) to indicate the percentage of annual revenue each month would provide if there was no revenue growth. The percentage for the 12th month of the year is calculated to ensure the annual total is 100%. Use the 12th month percentage as a check on your inputs. The initial value is 8.3% (1/12) for all months. Year 1 Percentage by Month values are applied as default values to all added revenue lines and following years. You can overwrite these if desired.

Budget Business Download Help License +bizpep.com

License Budget Business

Please consider supporting application development. Licensing your application will fully enable all functions.

License your application now

$69.00 USD per year

Secure online transaction processing is provided via PayPal. License details are sent by email as soon as your transaction is processed and will fully enable your application.

Application suitability must be independently assessed and use indicates acceptance of any and all associated risk.

Budget Business Download Help License +bizpep.com

I love this tool...

Renee Crawford

I am using the budget program and love it. Thanks so much. You must have worked very hard on this program, it is very good. I think that your programs are just great.

Jim Vaive

Excellent follow up service - great good value product.

Sue Williams

You are amazing. I have never seen a software provider caring about the end users and inviting their comments.

Krish Sethumadhavan

You guys are fantastick ...excellent service each and every time, without fail.

Ron Scott

...you guys were great!

Doug Ingle

I'm very impressed with your service and response. I wish all companies could be like this.

Michael Bolt

It is really a pleasure to have done business with you and your company. You are prompt, pleasant and always there when I needed you. Keep up the good work.

Imtiaz Abdulla

Keep up the good work!!

Bruce Frey and Maggie Cosgrove

Great as usual, Thanks.

Otto Stromfelt

Excellent for the three items.

Andres Duany

These are practical business tools and the service that you offer for modification and assistance to adapt to practical circumstances is outstanding.

Ian Fortuin

I really appreciate your time and responsiveness... I'll definitely be back to your site soon.

Ray Bennett

I like the simplicity and layout of your product.

Mark Holmes

This was my first software purchase over the internet. I am very please with the results.

Bonny Nichols

Whole transaction and result well done.

Brian O'Donohoe

Thank you sir for your prompt response and excellent service.

Jamshir Nasimi

Your help has been great!

Kathy Long

Thank you VERY MUCH for your help. I will be buying the program in the next few days.

Pete Brown

Thanks. Great service as always.

Tim Baugh

Thank you for your quick and helpful response.

Marjorie Lorimer

Thank you for the quick and effective response.

Dick Gibson

I've been very impressed with your customer service.

Phil Fleet

I recently purchased your software, which I think is great.

William Roach

Thanks. I love your stuff!

Kenny Pearmain

Worked like a charm.

Rob White>

You guys are great!

Dennis O'Block

Great product.

Jan Jacobson

... really impressed.

Chris Nagel

I think you have a great solution.

Ken Roach

...I'm extremely pleased. It shows very clearly what I've suspected.

Mervyn Groves

... the software performs very well.

Paul O'Dwyer

Your revisions to my code worked perfectly!

Kim Chapin

Thanks for your excellent results.

Bud Reed

...we highly recommend ...

Barbara Stafford

Really like the spreadsheet!

Gary Ellinger

I like the software very much.

Phil Thomas

Everything worked great! Thank you very much. I will be sure to refer your script as I meet people who need it :). Overall I am very satisfied with my experience using your solution.

Kyle Rodeck

Thank you so much...The file works great.

Dane Young

I just bought your scripts and they work great...Simple and worked perfectly, thanks...Did exactly what I needed it to do.

Pete Friebel

You were quick to respond and your product worked seamlessly.

Greg Gossler

I appreciate your assistance and your support. I will spread the word...I'm very much impressed.

Paul Forman

Thanks David. Your customer support is very impressive. I will refer more people to your company.

Syed Ali

I just purchased and I've got to tell you it's super easy to use and your directions are extremely easy to follow and understand... and at such a reasonable price. Thanks for your time and thanks for creating such a fine product!

Kenneth Brodeur

Thanks again for your concern and solution to our problem issue. We will gladly recommend your company...

Alan White

Thank you very much indeed for your help. I have recommended two of my clients purchase your script so far, and will continue to do so.

Mat Greenfield