BAS Business GST and BAS Accounting (au)

BAS Business Accounts Download Help License +bizpep.com

BAS Business Accounts for small and micro cash basis business accounting including Australian Goods and Services Tax (GST) and Business Activity Statements (BAS) recording

BAS Business Accounts is an easy to use business accounting application encompassing Australian Goods and Services Tax (GST) and Business Activity Statement reporting (BAS). It includes a quarterly and an annual Business Activity Statement (BAS) generated directly from the Accounts. It is intended for small business using the Cash Accounting method and reporting Australian GST.

BAS Business Accounts is designed for small, micro and home based business to provide simple and effective cash basis business accounting including GST and BAS reporting. Based on user feedback it simplifies your tax obligations. Standard business accounting software provides a range of functionality not required by most small businesses. This adds additional complexity to what should be a quick and easy transaction recording process. BAS Business Accounts Software is specifically designed for ease of use and interpretation. Input requirements are minimized with only an Account selection and the total Received or Paid required for a transaction. It includes preset Goods and Services Tax GST items and automatically completed quarterly and annual Business Activity Statements BAS which are generated directly from recorded accounts. As each transaction is entered within a month range a date input is not required however it can be included along with any other notes in the transaction Comments area. Totals are calculated by month, quarter and year with monthly Income, Expense and Profit totals graphically displayed.

Once Accounts are setup Income and Expense item transactions are added directly from drop down lists reflecting the set up Accounts. A Comments column allows additional details to be added for each transaction, however this can be left blank unless it adds required detail. From the selected Account details any GST to be applied is identified and Income or Expense and GST components of the total Received or Paid are calculated.

Income and Expense lines can be continued across following months and quarters to provide easily identified consistent accounts across months to ensure all transactions have been recorded. Standard spreadsheet functions can be included as input values for repeating inputs including Account, Comments, Received and Paid values. This allows a single input to be reused and reflected in following months. Income, Expense and Profit values for each month are compiled and plotted on the Income and Expense by Month chart. This excludes any GST components and provides a clear indicator of business performance and trends over time.

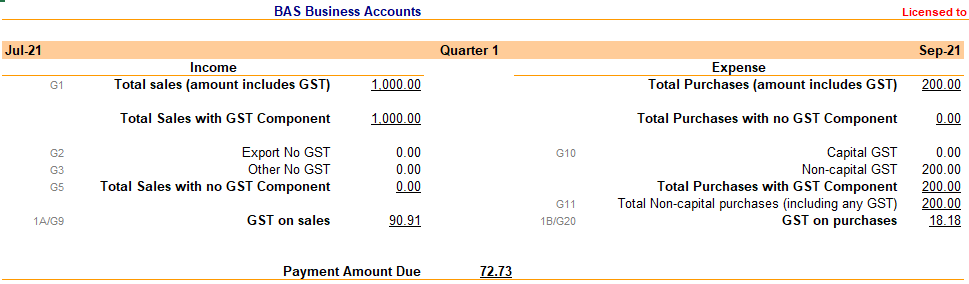

The BAS sheet displays standard Business Activity Statements by quarter and year. The BAS amounts are calculated straight from the transactions recorded on the Income and Expense sheets. Standard BAS codes are provided for each item and the amounts can be transferred directly to a Business Activity Statement.

According to client feedback BAS Business Accounts is an "excellent system" which "has really simplified my tax and therefore my life!". Perhaps it can do the same for you?

"the software has really simplified my tax and therefore my life! Thanks so much!"

"Thank you so much! I always have confidence in your system and your advice... Now to begin my third year with your excellent system ... How lucky I am to have bought your software. Thank you"

I have loved your BAS Business Accounts ... and think it's ideal for sole traders (which was the reason I purchased it).

I think it is a very useful spreadsheet and I'm using it and I haven't found anything better and have stopped looking.

Thank you so much. All submitted thanks to your generous help. I won't be as stressed next time knowing how helpful you are, having said that the hard work is done.. Wishing you well.

You can Download BAS Business Accounts free of charge for evaluation. It is available as a standard spreadsheet (.xlsx file developed with Microsoft Excel) and will run on most spreadsheet applications.

As an alternative to our spreadsheet based application we have released a web based small business BAS and GST accounting package. BAS-I.C is a streamlined web based accounting system designed specifically for small business allowing you to easily manage your Australian Business Activity Statement ( BAS ) and Goods and Services Tax ( GST ) obligations.

So if you prefer a web based accounting system Give BAS-I.C a try here...

BAS Business Accounts Download Help License +bizpep.com

Download BAS Business Accounts

Download BAS Business Accounts - Compressed Zip file

basbusinessaccounts.zip

or

Download BAS Business Accounts - .xlsx file

basbusinessaccounts.xlsx

This application is a spreadsheet developed in Microsoft Excel and will run on Microsoft Excel and most other spreadsheet applications. You can download BAS Business Accounts free of charge for evaluation. In evaluation mode some functionality is restricted. To license your application and fully enable all functions requires the purchase of an application license. If you have not already please consider buying a license to fully enable your application.

If you download the Compressed Zip file unzip/uncompress the downloaded file and save the content .xlsx application file. If you download the .xlsx file simply save the .xlsx file. Open the .xlsx file and follow the instructions. This application does not access or alter your system or system files in any way. To uninstall simply delete the saved files.

Application suitability must be independently assessed and use indicates acceptance of any and all associated risk.

BAS Business Accounts Download Help License +bizpep.com

Help BAS Business Accounts

BAS Business Accounts includes preset Tax Items for standard Australian Goods and Services Tax GST and Business Activity Statements BAS recording on a cash basis. These are applied to automatically generate quarterly and annual BAS statements. BAS Business Accounts is designed for small, micro and home based Australian business to provide simple and effective cash basis business accounting. It is specifically designed for ease of use and interpretation. Input requirements are minimized with quick setup for Accounts and preset Goods and Services Tax GST items. It also includes automatically completed quarterly and annual Business Activity Statements BAS which are generated directly from recorded accounts. Totals are calculated by month, quarter and year with monthly Income, Expense and Profit totals graphically displayed.

It can also be used by businesses with no tax recording requirement or non-Australian businesses.

Quick Start

- The Tax sheet is preset with standard Australian GST Tax Items and percentages for both Income and Expense transactions. No additional setup should be required.

- On the Accounts Sheet setup Income and Expense accounts by inputting an Account name and selecting the applicable GST Tax Item from the drop down list. The applicable GST Tax % will be displayed. If no Tax Item is selected the Tax % will be 0.

- On the Income sheet input the start date of the financial year. Add line items for the first month by selecting the Account from the drop down list and inputting the amount Received. Any GST tax component will be calculated. Repeat for all Income items. For future months add Income items to the applicable month columns. The same items can be added multiple times in any month and in any order however it is recommended that regular monthly items be added first and repeated on the same row in following months providing an easy 1 line check to ensure a record is made for each month.

- On the Expense sheet add line items for the first month by selecting the Account from the drop down list and inputting the amount Paid. Any GST tax component will be calculated. Repeat for all Expense items. The same items can be added multiple times in any month and in any order however it is recommended that regular monthly items be added first and repeated on the same row in following months providing an easy 1 line check to ensure a record is made for each month.

- Totals for each Month and Quarter are provided at the top of Income and Expense sheets.

- Income and Expense by Month displays and charts monthly income, expense and profit. This is exclusive of any GST tax component.

- The BAS sheet displays standard Business Activity Statements by quarter and year. The BAS amounts are calculated straight from the transactions recorded on the Income and Expense sheets. Standard BAS codes are provided for each item and the amounts can be transferred directly to your Business Activity Statement.

- You can save the file with different file names to use with multiple businesses and years.

Welcome

The Welcome sheet provides software and license details. When you purchase an application license you will receive License Details by email. To license your application input your License Details into the blue cells at the bottom of the Welcome sheet and save the spreadsheet. Current license details are displayed in red.

Income

The Income sheet is where all Income transactions are recorded. It consists of Account, Comments, Tax Item, Income, Tax and Received columns for each month. Totals for each Month and Quarter are at the top of the Income, Tax and Received columns. Months are grouped in Quarters with Account totals by Quarter and Full Year Account totals following the last Quarter. Account totals are displayed in the order of Accounts on the Accounts sheet.

Set up the Accounts sheet before adding transactions.

Income transactions are added by line for each Month by selecting an Account from the drop down list and inputting a Received amount.

Start Date

Initially input the start date (first day) of the financial year. This is used to calculate following months and is also applied to the Expense sheet.

Account

Add a transaction by clicking a blue cell in the Account column and scrolling the drop down list to select the required Account.

Accounts can be added in any order however by setting regular Accounts first (at the top of the column) and setting following months to be the same as previous months a continuous one line Account is established. This provides easy transaction verification over months. Accounts for following months can be set to be the same as previous months using standard spreadsheet functions. To do this in the following Account cell type = and then select the preceding Account cell and click enter.

Accounts in the drop down list come from the Income Account column in the Accounts sheet and are displayed in the order they appear on the Accounts sheet. If a new Account is required it should be added to the Accounts sheet. Accounts that are not set in the Accounts sheet will not be included in Totals.

Comments

Add any additional transaction detail to the Comments column. This could be a transaction date or reference number however to minimize input it can be left blank unless it adds required detail.

Tax Item

The Tax Item column displays the Tax Item associated with the selected Account as set on the Accounts sheet. The Tax % for the Tax Item will be used to calculate the Tax amount for the transaction. If there is no Tax Item associated with the selected Account this will be 0.

Income Tax Items preset include Export No GST (also described as Export Sales) with a Tax % of 0, Other No GST (also described as Other GST-free sales) with a Tax % of 0, and GST (also described as Total sales subject to GST) with a Tax % of 10.

Accounts with transactions for Export items should have the Tax Item Export No GST. This will include sales to overseas entities where GST is not applied.

Accounts with domestic transactions for items with No GST component should have the Tax Item Other No GST. This will include sales of items that are not subject to GST.Accounts with transactions with a GST component should have the Tax Item GST. This will include domestic sales where GST is applied.

Income

This is the calculated Income amount. It is the Received amount minus any GST amount.

Income = Received - GST

This is the actual business income amount. It excludes any Tax component received.

Tax

This is the calculated GST Received amount. It is the Received amount minus the Income amount.

GST Received = Received - Income

This is the tax amount collected by the business.

Received

Input the Received amount for the transaction. This includes any GST component and is the total amount received by the business for the transaction.

Expense

The Expense sheet is where all Expense transactions are recorded. It consists of Account, Comments, Tax Item, Expense, Tax and Paid columns for each month. Totals for each Month and Quarter are at the top of the Expense, Tax and Paid columns. Months are grouped in Quarters with Account totals by Quarter and Full Year Account totals following the last Quarter. Account totals are displayed in the order of Accounts on the Accounts sheet.

Set up the Accounts sheet before adding transactions.

Expense transactions are added by line for each Month by selecting an Account from the drop down list and inputting a Paid amount. The Month values applied correspond to those set on the Income sheet.

Account

Add a transaction by clicking a blue cell in the Account column and scrolling the drop down list to select the required Account.

Accounts can be added in any order however by setting regular Accounts first (at the top of the column) and setting following months to be the same as previous months a continuous one line Account is established. This provides easy transaction verification over months. Accounts for following months can be set to be the same as previous months using standard spreadsheet functions. To do this in the following Account cell type = and then select the preceding Account cell and click enter.

Accounts in the drop down list come from the Expense Account column in the Accounts sheet and are displayed in the order they appear on the Accounts sheet. If a new Account is required it should be added to the Accounts sheet. Accounts that are not set in the Accounts sheet will not be included in Totals.

Comments

Add any additional transaction detail to the Comments column. This could be a transaction date or reference number however to minimize input it can be left blank unless it adds required detail.

Tax Item

The Tax Item column displays the Tax Item associated with the selected Account as set on the Accounts sheet. The Tax % for the Tax Item will be used to calculate the Tax amount for the transaction. If there is no Tax Item associated with the selected Account this will be 0.

Expense Tax Items preset include Capital GST (also described as Capital purchases) with a Tax % of 10, Non-capital GST (also described as Non-capital purchases) with a Tax % of 10, and No GST (also described as Total Purchases with no GST Component) with a Tax % of 0.

Accounts with transactions for Capital items that include a GST component should have the Tax Item Capital GST. This will usually include domestic purchases of Capital items.

Accounts with transactions for Non-capital items that include a GST component should have the Tax Item Non-capital GST. This will usually include most day to day business purchases.

Accounts with transactions with no GST Component should have the Tax Item No GST. This will include purchases from overseas entities and other transactions where GST is not applied.Expense

This is the calculated Expense amount. It is the Paid amount minus any GST Paid amount.

Expense = Paid - GST Paid

This is the actual business expense amount. It excludes any GST component paid.

Tax

This is the calculated GST Paid amount. It is the Paid amount minus the Expense amount.

GST Paid = Paid - Expense

This is the tax component paid by the business.

Paid

Input the Paid amount for the transaction. This includes any GST Paid component and is the total amount paid by the business for the transaction.

Accounts

If required set up the Tax sheet before adding Accounts.

The Accounts sheet is used to setup the Income and Expense Accounts that are selected from the drop down lists in the Accounts column of the Income and Expense sheets. Income Accounts are set up in the Income columns and Expense Accounts are set up in the Expense columns.

Accounts can be added in any order however setting regular Accounts first (at the top of the column) will provide the easiest to use structure. The Account order is reflected in both the drop down lists and the Account Totals on the Income and Expense sheets.

Account

Input the Account name. Any name can be applied to an account but it must be unique and should be descriptive clearly identifying the transactions it is intended for. An account can encompass a range of transactions or be very specific depending upon the level of recorded detail required and displayed in Account totals.

Tax Item

Select any Tax Item that applies to the Account from the drop down list. If the Account does not include a Tax Item this can be left blank.

Accounts with transactions for Export items should have the Tax Item Export No GST. This will include sales to overseas entities where GST is not applied.

Accounts with domestic transactions for items with No GST component should have the Tax Item Other No GST. This will include sales of items that are not subject to GST.

Accounts with transactions with a GST component should have the Tax Item GST. This will include domestic sales where GST is applied.

Accounts with transactions for Capital items that include a GST component should have the Tax Item Capital GST. This will usually include domestic purchases of Capital items.

Accounts with transactions for Non-capital items that include a GST component should have the Tax Item Non-capital GST. This will usually include most day to day business purchases.

Accounts with transactions with no GST Component should have the Tax Item No GST. This will include purchases from overseas entities and other transactions where GST is not applied.

Tax %

The % column displays the Tax % for the selected Tax Item as set in the Tax sheet. This will be used to calculate the Tax amount for transactions set to the Account. If there is no Tax Item associated with the selected Account this will be 0.

Tax

The Tax sheet is used to setup the Income and Expense Tax Items that are selected from the drop down lists in the Tax Item column of the Accounts sheet. Income Tax Items are set up in the Income columns and Expense Tax Items are set up in the Expense columns.

The Tax sheet is preset with standard Australian GST Tax Items and percentages for both Income and Expense transactions. No additional setup should be required.

Income Tax Items preset include Export No GST (also described as Export Sales) with a Tax % of 0, Other No GST (also described as Other GST-free sales) with a Tax % of 0, and GST (also described as Total sales subject to GST) with a Tax % of 10.

Expense Tax Items preset include Capital GST (also described as Capital purchases) with a Tax % of 10, Non-capital GST (also described as Non-capital purchases) with a Tax % of 10, and No GST (also described as Total Purchases with no GST Component) with a Tax % of 0.

The preset Tax Item names Export No GST, Other No GST, Capital GST and Non-capital GST are protected (shaded white) and can not be changed. They are applied directly in the BAS sheet and must match the BAS items.

The Tax % for all Tax Items can be adjusted if required.

Tax Item

Input the Tax Item name. Any name can be applied to a Tax Item but it must be unique and should be descriptive clearly identifying the accounts it is intended for.

Tax %

Input the percentage Tax that applies for the Tax Item. This input should be the base numerical percentage i.e. for 10% input 10. This will be used to calculate the Tax amount for transactions set to Accounts using this Tax Item.

Income and Expense by Month

The Income and Expense by Month sheet displays the Income, Expense and Profit totals by Month. These are also plotted on the Income and Expense by Month chart. This provides a quick visual indication of business financial trends and relationships. The totals exclude any Tax components and represent pure business Income and Expense.

BAS

The BAS sheet displays standard Business Activity Statements by quarter and year. The BAS amounts are calculated straight from the transactions recorded on the Income and Expense sheets. The calculations rely on the Tax Items applied to each Account to determine the correct allocation of amounts. Standard BAS codes are provided for each item and the amounts can be transferred directly to a Business Activity Statement.

GST on sales is the amount of GST received by the business from customers. GST on purchases is the amount of GST paid by the business to suppliers.

The Payment Amount Due is GST on sales minus GST on purchases. When the Payment Amount Due is positive the business is required to make payment for that amount to the tax office. When the Payment Amount Due is negative the business is owed that amount from the tax office.

BAS Business Accounts Download Help License +bizpep.com

License BAS Business Accounts

Please consider supporting application development. Licensing your application will fully enable all functions.

License your application now

$55.00 AUD per year

Secure online transaction processing is provided via PayPal. License details are sent by email as soon as your transaction is processed and will fully enable your application.

Application suitability must be independently assessed and use indicates acceptance of any and all associated risk.

BAS Business Accounts Download Help License +bizpep.com

I purchased your fabulous software in 2012 and have been using it since. Thank you!

Bron Evans

The software has really simplified my tax and therefore my life! Thanks so much!

Gail Tagarro

Thank you so much! I always have confidence in your system and your advice... Now to begin my third year with your excellent system ... How lucky I am to have bought your software. Thank you

Zoe Harrison

I have loved your BAS Business Accounts Software and think it's ideal for sole traders (which was the reason I purchased it).

Nicole Cornish

I think it is a very useful spreadsheet and I'm using it and I haven't found anything better and have stopped looking.

Antoine Matarasso

You have saved me some number crunching time! Greatly appreciated and thanks for your fast support.

Dave Vinegrad

brilliant thanks so much for your speedy assistance.

Gail Rice

Thank you so much. All submitted thanks to your generous help. I won't be as stressed next time knowing how helpful you are, having said that the hard work is done.. Wishing you well.

Belinda Walsh

I purchased your BAS Excel software and I like it.

Peter Stinson

You are amazing. I have never seen a software provider caring about the end users and inviting their comments.

Krish Sethumadhavan

You guys are fantastick ...excellent service each and every time, without fail.

Ron Scott

...you guys were great!

Doug Ingle

I'm very impressed with your service and response. I wish all companies could be like this.

Michael Bolt

It is really a pleasure to have done business with you and your company. You are prompt, pleasant and always there when I needed you. Keep up the good work.

Imtiaz Abdulla

Keep up the good work!!

Bruce Frey and Maggie Cosgrove

Great as usual, Thanks.

Otto Stromfelt

Excellent for the three items.

Andres Duany

These are practical business tools and the service that you offer for modification and assistance to adapt to practical circumstances is outstanding.

Ian Fortuin

I really appreciate your time and responsiveness... I'll definitely be back to your site soon.

Ray Bennett

I like the simplicity and layout of your product.

Mark Holmes

This was my first software purchase over the internet. I am very please with the results.

Bonny Nichols

Whole transaction and result well done.

Brian O'Donohoe

Thank you sir for your prompt response and excellent service.

Jamshir Nasimi

Your help has been great!

Kathy Long

Thank you VERY MUCH for your help. I will be buying the program in the next few days.

Pete Brown

Thanks. Great service as always.

Tim Baugh

Thank you for your quick and helpful response.

Marjorie Lorimer

Thank you for the quick and effective response.

Dick Gibson

I've been very impressed with your customer service.

Phil Fleet

I recently purchased your software, which I think is great.

William Roach

Thanks. I love your stuff!

Kenny Pearmain

Worked like a charm.

Rob White>

You guys are great!

Dennis O'Block

Great product.

Jan Jacobson

... really impressed.

Chris Nagel

I think you have a great solution.

Ken Roach

...I'm extremely pleased. It shows very clearly what I've suspected.

Mervyn Groves

... the software performs very well.

Paul O'Dwyer

Your revisions to my code worked perfectly!

Kim Chapin

Thanks for your excellent results.

Bud Reed

...we highly recommend ...

Barbara Stafford

Really like the spreadsheet!

Gary Ellinger

I like the software very much.

Phil Thomas

Everything worked great! Thank you very much. I will be sure to refer your script as I meet people who need it :). Overall I am very satisfied with my experience using your solution.

Kyle Rodeck

Thank you so much...The file works great.

Dane Young

I just bought your scripts and they work great...Simple and worked perfectly, thanks...Did exactly what I needed it to do.

Pete Friebel

You were quick to respond and your product worked seamlessly.

Greg Gossler

I appreciate your assistance and your support. I will spread the word...I'm very much impressed.

Paul Forman

Thanks David. Your customer support is very impressive. I will refer more people to your company.

Syed Ali

I just purchased and I've got to tell you it's super easy to use and your directions are extremely easy to follow and understand... and at such a reasonable price. Thanks for your time and thanks for creating such a fine product!

Kenneth Brodeur

Thanks again for your concern and solution to our problem issue. We will gladly recommend your company...

Alan White

Thank you very much indeed for your help. I have recommended two of my clients purchase your script so far, and will continue to do so.

Mat Greenfield